Point is, this industry is growing fast. It’s a great time to be in the equipment rental business.

If you manage your business well, you can see huge growth fast. Thing is, to do that, you need a plan.

You need to run the numbers. One of the things you can do this with, is the cost of your rental equipment.

How much are your loans? How long will it take, at what price, to repay those loans? How should you ensure that you get a good ROI on your equipment?

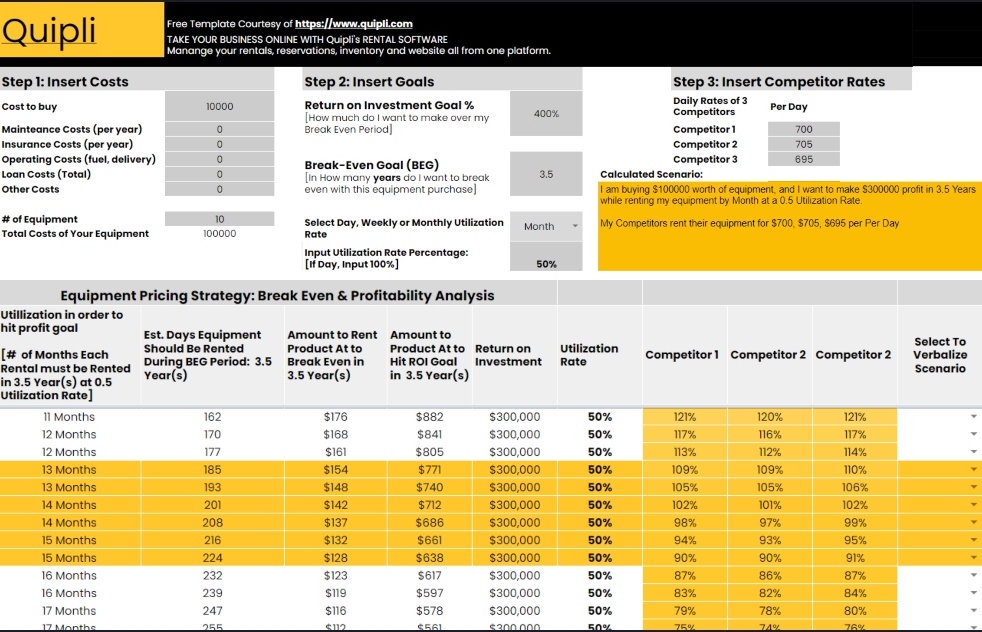

To help you answer these questions, we’ve created a detailed online calculator. Just plug in your numbers, and you can find out what you’ll need to do to make sure you make a profit.

Our Equipment Rental Cost Calculator Spreadsheet

To help you crunch the numbers, we’ve created an equipment rental cost calculator.

It’s in the form of a spreadsheet, which you can open and use in Google Sheets, Excel, or similar apps. It’s programmed to do the math for you – just enter your numbers, and you’re good to go.

Using Sheets or Excel, you can calculate the best daily, weekly, or monthly equipment rental rates that will get you the best ROI, while still remaining competitive.

So how do you use it? Below, we have a full rundown of what our calculator does, and how to use this simple but powerful tool to figure out how to get the best ROI on your investment into your business.

What you’ll need:

- Purchase cost of equipment

- Insurance cost

- Operating costs

- Loan costs

- Any other associated costs

- Your ROI goal

- The period of time over which you want to break even on the loan

- Your utilization rate (per day, per week, or per month.)

- Your utilization rate percentage (for daily utilization rates, you should enter 100%)

How to Calculate The Price of Your Rental Equipment?

When deciding how to properly price rental equipment, companies should understand the costs of owning their equipment, how often they can expect to rent their equipment per month, and any other costs that may be required.

Pricing for rentals should take the following into account:

- Initial cost of the equipment

- Any maintenance associated with keeping the equipment in good repair

- How often the equipment may be rented each month

- Any additional expenditures, such as staff or storage costs

Before pricing rental equipment, it’s important to conduct market research of other firms in your area that offers similar items for rent.

Find out how much they are charging for the rental of their equipment. Identify if there are any discounts offered for longer rental times or if additional costs associated with the equipment are passed on to their customers.

This article will discuss how to properly price rental equipment. It also includes an equipment rental rates calculator that can be used to help you figure out how long it will take to recoup your initial outlay.

Daily vs Weekly vs Monthly Equipment Rental Rates

In our calculator, you can set your rates by day, by week, or by month.

So which is the best option?

In short, the longer the rental, the better the daily rate equivalent should be. Longer rentals are massively valuable as they limit the number of transactions you have to make, and minimize downtime.

On the other hand, higher rates for shorter term periods means you’ll make more on each rental. Targeting customers that have longer rental periods will generally make for a more profitable and sustainable business that’s easier to manage.

Your administration and handling costs tend to be higher for shorter term rentals – keeping in mind that equipment needs to be cleaned, and undergo routine maintenance, between rentals.

There are different ways you can structure this, but daily rates – with weekly and monthly based off of the daily rate – tend to be optimal for most types of equipment rental, including heavy construction equipment.

A good way to do this is to start with the daily rate, then set monthly rentals based on the number of calendar days total in the rental period, plus a slight discount for the longer period. So if your daily rate is $200 for a piece of machinery, and say you’d be comfortable giving a 10% discount for a monthly rental as opposed to a daily one, you’d be looking at around $5,400 for a month-long rental period – a good deal for everyone involved.

You can also consider things like a discounted monthly rate for high-value recurring customers who rent for long term periods. But generally speaking, it’s best to charge by the day.

That way, calculating your equipment rental rates daily, monthly, and weekly in Excel or Google Sheets is also a lot easier.

Product Costs

When deciding how to price rental items, you must first figure out the cost of the equipment you plan to rent. The cost of the item should include the initial outlay for the product, as well as any interest expenses and upkeep costs. Upkeep costs can include storage, maintenance, and an allocation of staff wages as a proportion of the product.

Breaking Even

Your first task is to understand how long you expect it will take to break even with your initial investment in your equipment. Once you break even, your ROI improves substantially because you are renting your products almost purely for profit (with the exception of on-going costs such as maintenance, insurance, staff, etc.).

Return on Investment Goals

There are two different prices you can rent your product out at: at the break even price, or at a price with profit in mind.

If you rent your equipment out purely at your break even price, your overall rental price will likely be lower than your competitors, and thus will be more attractive for customers. However, recouping your initial investment will take more rental days.

Plus, there’s no reason to completely undercut your competitors, though offering a lower price is a good incentive for new customers to choose you.

With the right calculations, you can layer in an ROI goal while you are still in your break even phase.

An Example Rental Cost Calculation Scenario

Say, you purchased 10 pieces of equipment to rent which totaled $100,000.

You want to break even in 2.5 years.

In order to recoup your investment, you would need to rent out your 10 pieces of equipment about for a total of 200 days during 2.5 years at a price around $200 per day.

However – your competitor rents this piece of equipment out for $400 a day. Even lowering your price $50 underneath theirs would be a nice perk for your customer. If you were rent out your equipment at $350, you could recoup your costs in in around 115 days.

But – if your competitor is renting for $400 a day – they are probably renting at a profit instead of breaking even – as should you.

Back to the drawing board:

10 pieces of equipment: initial cost = $100,000

Break Even Goal: 2.5 Years

Competitor rental price: $400 per day.

Your ROI goal: 250% ie 150K on top of your initial investment.

If you rent your 10 pieces of equipment a total of 350 times in 2.5 years at a price of about $400 per day, you would break even in 2.5 years while making 150K.

The key factor is the number of times you think your market requires during this time period. Is renting 10 pieces of equipment for a total of 350 times in 2.5 years seem possible?

If this seems unreasonable, you have a couple levers to pull.

1) Your ROI goal might be too high. If you lower your ROI goal, then number of days you need to rent lowers.

2) Your Break Even Goal: You could increase your Break Even Goal, so that it takes longer to pay off your initial investment. However, rule of thumb is that you should Break Even with your initial investments at a max of 3 years.

3) Your rental price. If you price below your competitors, you may gain an edge in your market which would increase potential renters.

Utilization Rates

Some niches – most commonly construction – price their equipment based on utilization rates. During peak seasons, you might expect some of your equipment to rent out for half of a month. Thus – a 50% utilization rate.

Identifying a utilization rate requires having a strong understanding of your industry, however can be helpful for planning and maintenance costs.

If you are new to an industry, considering just how many days you need to rent during your break even period may be more helpful in that it simplifies what your goals are. Instead of thinking, “I need to rent out my equipment 50% of each month for 2.5 years”, you can replace this with “I need to rent out my equipment for x number of days over 2.5 years.”

Post Breaking Even Period Profit

Once you have reached the end of your Break Even Period, your profit margins will greatly increase since now you are renting almost purely for profit. With the exception of recurring cost such as insurance, maintenance, staff, etc. your equipment is paid for.

Here – you can calculate further your future profit and the calculation is quite simple.

(Rental Price x Expected Days Per Year it Is Rented) – Annual Costs = Annual Profit

What Are the Advantages to Understanding the Profitability of Your Equipment?

Knowing what items in your equipment rental company are generating a profit can help you better understand the mechanics of your operations. If you are consistently generating a regular income from particular items that you rent, you can decide to purchase more of them.

In contrast, if you have items that aren’t very popular with your customers, you may decide not to keep many of them available to rent. Thus, you’ll be able to have a more balanced approach to managing your event equipment inventory.

The equipment rental cost calculator can give you a lot of insight into understanding what benefits your business and what doesn’t. You don’t want to invest in products that have a high product cost and don’t sell well.

In that case, you’d be left with reduced profits or even losses. Understanding the strength of your product mix can help reduce your spending on unprofitable items.

USE QUIPLI’S RENTAL EQUIPMENT CALCULATOR TO FORMULATE A BREAKEVEN POINT

Equipment Rental Pricing FAQ

How do I calculate equipment rental rates?

The best way to figure out how to price your rental equipment is to price it by day, by week, or by month. (Rather than using a fixed rate structure.) Some of the factors to keep in mind include:

- Initial cost and/or loan payments

- Maintenance cost

- Your goal for time to break even

- Your ROI goal (what percentage you want to make back vs the cost)

- What your competitors are charging for the same equipment

How do I calculate my equipment utilization rate?

To calculate your time utilization rate – that is, what percentage of the time a particular piece of equipment is in use – you can use the following simple formula:

(Days rented)/(days available for rental) = Time Utilization Percentage

The best time utilization percentage to aim for, for your fleet or inventory as a whole, is 75%. Keep in mind that equipment can often be under routine maintenance between uses, or can be in the shop for repairs. No piece of equipment is going to have a 100% utilization rate individually, regardless of the time period by which you’re measuring it.

How do I calculate the cost of my equipment?

The initial up-front cost of the equipment – whether you took out a loan, or bought it outright – is only part of its total cost.

Other factors to take into account include:

- Maintenance and servicing

- Repairs

- Equipment inspections

- Unexpected costs, like unanticipated facility downtime or other issues

- Upgrades and improvements to the equipment

- Depreciation over time

Here’s a formula that you can use for this:

- (Total cost of a piece of equipment) x (5% / month) x 13 x 80%

How do I assess my competitors’ rates?

Market research is a big part of tailoring your equipment rental rates. (Our calculator has a section where you can enter what your top competitors are charging.)

To do this, you want to take a look at what’s standard in your area for a particular piece of equipment. This involves looking not only at pricing, but at how your competitors are positioned.

When looking at local competitors, you should ask:

- How is a given competitor’s brand positioned? Are they positioning themselves as a premium offering, or are they catering more to customers who are shopping on price?

- What prices are customers willing to pay for renting a given piece of equipment? What are typical minima and maxima locally?

- Is price a big factor in your target customers’ decision making process? (This can depend on what kind of equipment rental you’re offering, as well as what particular piece of equipment you’re analyzing.)

Wrapping Up

If you are in the equipment rental business, it’s important to have a full understanding of how to calculate rental rates, as well as ways to increase your profitability. Using an equipment rental cost calculator can help you determine your break-even point for each item of equipment that you have. Once you know your break-even point, you’ll be in a better position to set your rental rates.

Quipli offers lots of insight geared towards assisting equipment rental companies who want help in growing their businesses.

Our software includes equipment reservation management, inventory management, and a reporting & utilization data tool. All of these modules can help you put your best foot forward for your equipment rental business. For a free demo of our equipment rental software, contact our team today!