Managing a rental business involves juggling numerous tasks, but perhaps one of the most crucial yet often overlooked aspects is streamlining the billing and invoicing processes.

Here are seven tips to help you do just that.

1. Use software to automate invoicing

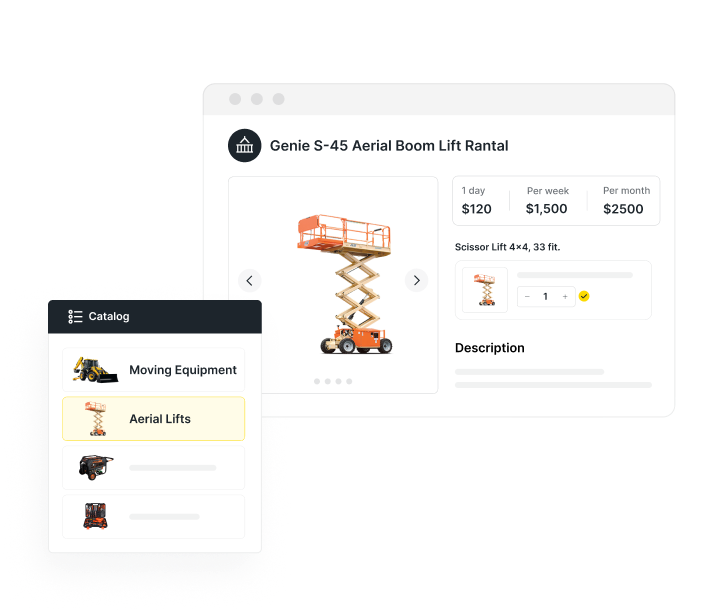

One of the best ways to simplify and streamline your billing processes is to use dedicated software. This can include not only accounting software like Quickbooks, but also apps like Quipli that are designed specifically for equipment rental businesses.

Quipli features automatic invoice creation, saving you from the tedious task of creating each invoice manually.

Quipli also integrates with Quickbooks Online, seamlessly sending over your invoices and payments. This integration eliminates the need for double entries, reducing errors, and freeing up more of your valuable time. With this kind of automation, you can significantly reduce the risk of human errors, misplaced invoices, and missed billing opportunities.

2. Be clear and explicit about your payment terms

Secondly, you need to be clear about when payments are due and how long your customers have to pay them.

These terms should be set based on what works best for you and your business – it could be a week, a month, or somewhere in between.

However, you have to be careful when setting equipment rental payment terms. Avoid overly long terms as they could harm your cash flow, especially considering the high upfront costs and maintenance expenses typically associated with rental equipment.

Make sure your payment terms are prominently displayed on every invoice to prevent misunderstandings. Verbal communication of these terms during contract discussions is also advisable, especially with new clients, to ensure they fully understand their obligations and to prevent potential disputes down the line.

3. Institute late fees to discourage late payments

Next, you want to encourage customers to make sure your invoices are paid on time by instituting a fair and reasonable fee for late payments. These late fees should be stipulated in your rental contract.

There are a few different options for how you can structure your late fees. One of the most common structures is 5% of the total monthly rental cost, but you can also opt for a flat fee by day, week, or month.

Generally, it’s best practice to also set a cap or limit on how much a customer can accrue in late fees, rather than letting them accumulate indefinitely.

Accounting for costs from late returns and maintenance delays

For an equipment rental business, it’s crucial to consider the costs associated with late returns and delayed maintenance. When a customer doesn’t return a rental unit on time, it disrupts your processes and can cost you money.

To cover this, you might consider implementing a specific fee structure for late returns. This will help compensate for the potential loss of rental opportunities and extra maintenance expenses. Also, your late fee policies should account for equipment wear and tear, as late returns may result in accelerated depreciation and increased servicing needs.

It’s essential to check your local city and state laws regarding late fees – some regions might require a grace period, stipulate a maximum amount you can charge, or impose other restrictions.

Send reminder notifications to your customers before the due date, and consider implementing a grace period before late fees apply. Such practices not only foster prompt payments but also contribute to maintaining positive client relationships.

4. Number your invoices for easier reference

Numbering your invoices will make it a lot easier to find them if you need to look at them, or when you need to discuss a specific invoice with a recurring client. Quipli does this automatically, taking one more task off your plate.

For equipment rentals, clear and unique invoice numbers are not just useful for administrative tracking, but can also be tied to specific pieces of equipment or rental contracts. This enables easier tracking of which equipment has been rented out, to whom, and for what duration, thus ensuring an accurate record of equipment usage.

You can also link invoice numbers to equipment serial numbers to help streamline your service and maintenance tracking. This is particularly useful in case of any equipment malfunctions or damages – the invoice can serve as a point of reference for warranty claims or to allocate repair costs.

Remember, including the invoice number in all client communications related to that particular invoice can prevent fraud, and streamline any discussions or disputes related to the rental or maintenance of the equipment.

5. Make it as easy as possible for customers to pay online

Paying online is quick and convenient for the customer, but it also benefits your business by making it easier to get paid. Quipli integrates with Stripe for online payments and also integrates with Quickbooks Online to streamline your equipment rental accounting.

Quipli also simplifies things on the customer’s end. Your customers can register as users and login to make payments, add and remove payment methods, and view their invoices and purchase history.

By making the payment process as frictionless as possible, you can expedite your revenue collection and enhance customer satisfaction.

For higher-cost equipment or longer-term rentals, you may also want to consider introducing structured payment plans that break the total cost into smaller amounts.

Damage deposits or insurance fees should also be included in the online payment process.

6. Follow up with reminders and late notices in a timely manner.

In the equipment rental business, timely follow-ups with reminders and late notices play a pivotal role in ensuring steady cash flow. With various types of equipment rented out for different durations and at varying rates, tracking each rental contract’s payment due dates can be a cumbersome process. However, it is an essential step to prompt customers to settle their invoices and, thus, ensure you get paid on time.

One way to approach this is by setting up automated email reminders to be sent out to customers a few days before their payment due date.

This proactive step not only serves as a courteous reminder for your clients but also gives them ample time to address any potential issues that might prevent them from making timely payments. For instance, if a customer has lost their invoice, a reminder email can prompt them to request a new one, ensuring they have the necessary information to pay on time.

If someone misses a payment, sending out late notices can serve as a firm yet professional nudge to your clients to settle their outstanding invoices. In the equipment rental industry, a delay in one payment can set off a domino effect on your ability to maintain, repair, or replace your equipment inventory. It’s important to make sure equipment is returned, and paid for, on time.

In addition to improving your cash flow, these reminders and notices can also help you provide better overall customer service. Clear communication about due payments helps prevent misunderstandings that can damage your relationships with your customers. It shows your clients that you value transparency and efficiency, traits that can set you apart in the competitive equipment rental marketplace.

7. Offer multiple payment options

Our final tip for streamlining your billing and invoicing process in your equipment rental business is to offer multiple payment options.

Doing so helps increase your chances of getting paid on time, by making things as convenient as possible for your customers.

Quipli allows customers to add multiple payment methods and select which one they want to use for any given invoice – cash, debit, credit, and more. By offering a wide range of payment methods, you cater to the preferences of different clients, accommodating their specific needs and financial practices, thereby encouraging prompt payments.

Quipli makes billing and invoicing easier than ever for rental companies

By using these invoicing tips and strategies, and incorporating Quipli’s innovative rental management software, you can revitalize and streamline your company’s billing processes – leading to increased efficiency and customer satisfaction.

Quipli’s powerful rental business software can automate invoice creation, tie it to individual equipment units or rental contracts, and integrate with Quickbooks Online for seamless payment processing. It’s a great way to consolidate and streamline the financial aspects of your business and keep everything running smoothly.

Along with transaction management, Quipli can also give you valuable insights into equipment usage and financial trends through its analytics. You can specify information like clear payment terms, late fees, and multiple payment options that take into account the specific circumstances of renting equipment.