One of the biggest questions that new business owners have is, “Do you charge tax on rentals?” It’s not always clear what the right move is, and failing to meet tax requirements can have serious consequences and penalties. It’s always best to thoroughly research what your company’s tax obligations are.

Quipli Can Adjust Your Sales Tax Automatically – Book a Demo Today

Is There Sales Tax on Rental Equipment?

You might think that there wouldn’t be any applicable sales tax on rental equipment because you aren’t really selling it. However, this generally isn’t the case.

Most rentals are subject to sales tax, just like any other goods or services. Finding out the right amount to collect can be difficult due to state, city, and county tax rates varying.

You’ll need to look up the exact tax regulations for your geographic area, which can vary substantially from place to place. Not only do tax codes vary substantially from state to state, but there may be additional taxes levied by your specific city or county.

While handling sales tax might seem like an additional burden when starting your equipment rental business, the process isn’t all that complicated. With effective software for managing your business, you shouldn’t have any trouble keeping up.

Sales Tax and Different Types of Equipment Rentals

When you’re considering if there is sales tax on rental equipment, you need to take a look at exactly what it is that you’re renting out.

Different categories can have different requirements and exemptions, and knowing ahead of time will save you a lot of trouble in the long run. Vehicles are one of the most prominent categories that have major differences.

Vehicles and other types of heavy-duty machinery can often fall under other tax schemes. In many states, they face specific taxes called excise taxes.

This tax can be on top of or in place of regular state, city, and county sales taxes. In general, vehicle rentals will have multiple taxes applied that will be very specific to individual jurisdictions.

Excise Tax & Equipment Rentals

Several states – including but not limited to Indiana, Michigan, and Washington – have additional excise taxes on heavy equipment rentals. An excise tax is an additional tax, imposed on certain kinds of goods, services, or activities – in this case, on equipment rentals.

A good example of an excise tax we all encounter every day is the federal gas tax.

Like a sales tax, an additional excise tax on equipment rentals will impact the final amount that you’ll need to charge each customer that rents from you. Excise taxes can be imposed at any of the following times, depending on state and context:

- Sale or use after something is imported from another country

- Sale or use by the manufacturer

- Sale or use by a retailer

- Sale or use by a customer

This tax can be on top of or in place of regular state, city, and county sales taxes. In general, vehicle rentals will have multiple taxes applied that will be very specific to individual jurisdictions.

Sales Tax in Different States

Of course, anything to do with taxes for your rental business is going to be affected by what state you’re in. Here’s a quick rundown of a few states with prominent differences or exceptions when it comes to sales taxes on equipment rentals.

If you’re not sure about your own state, it’s a good idea to consult with an accountant, attorney, or another professional with expertise in local tax code.

California

In California, there is a sales tax on essentially every type of tangible property rental. There are also taxes applied specifically to motor vehicle rentals.

Along with sales tax, California also imposes a “use tax,” in some cases in which taxable items are purchased for use, storage, or consumption, but not for direct sale. This can sometimes apply if you purchase equipment out-of-state from an out-of-state vendor.

- Leases are taxed based on rental receipts or payments

- Use tax can apply if you remove a unit from your fleet for personal use (versus rental by a customer)

- Some districts may have their own additional taxes, with total sales tax exceeding the typical 7.5%. Check your local city or county tax code, or consult with an accountant in your area, to find out if this applies to your business.

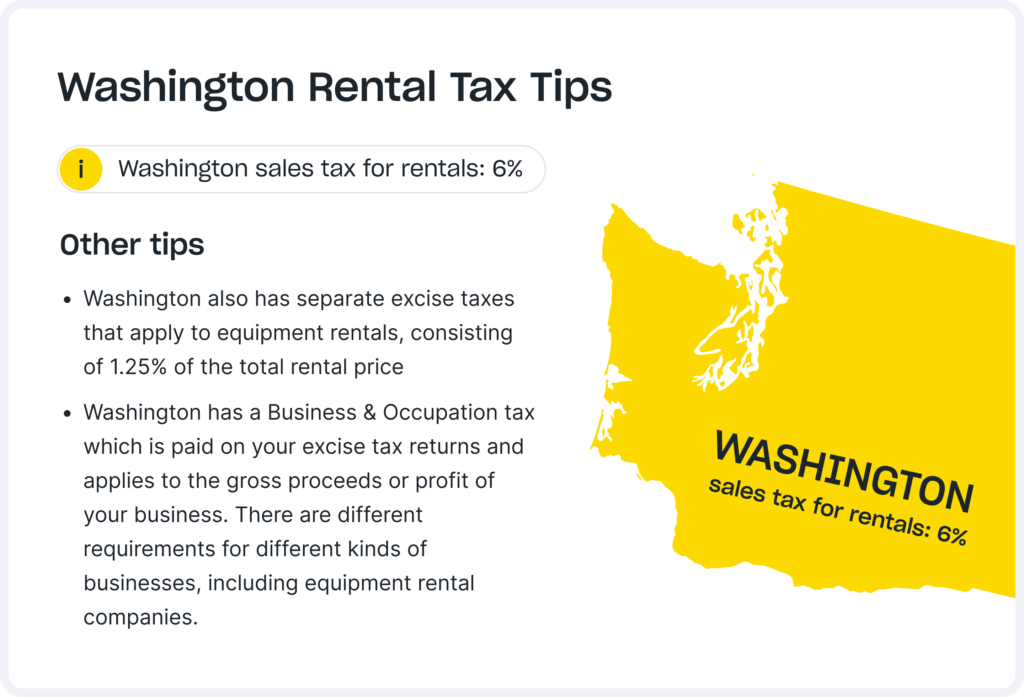

Washington

In Washington, there is both the regular sales tax and the Business and Occupation tax to consider.

The Business and Occupation Tax is measured based on the total value of the products, gross proceeds of sale, or gross income of a business.

There are no exemptions available for the B&O tax for labor, materials, or other costs of doing business. However, there are several tax credits that are subtracted from the B&O tax on your business’s tax return:

- Rural County B&O Credit for New Employees

- High Technology B&O Credit

- Small Business B&O Tax Credit

- Multiple Activities Tax Credit

- Credit for Hiring Unemployed Veterans

Washington’s B&O tax is paid on your excise tax returns.

The specifics here can vary with tax classification, which depends on your type of business and what activities it engages in.

You can check out the tax classification details for rental businesses in Washington here: https://apps.leg.wa.gov/wac/default.aspx?cite=458-20-211

Texas

Texas has a motor vehicle rental tax, which is applied to equipment rentals of heavy construction machinery and other types of vehicles, as well as to passenger car rentals.

Texas tax law handles motor vehicle rentals a bit differently than straightforward sales. They’re exempt from the general sales tax, but have another tax with different rates applying depending on the duration of the rental.

When you rent a vehicle to a consumer in Texas – including heavy construction equipment – you must also collect the motor vehicle rental tax from the customer, as part of their total payment. (In a very few cases, the customer may have some form of exemption, but this is relatively rare.)

This additional tax is calculated based on gross rental receipts – this means the total amount charged to the customer for the rental. So it functions similarly to a typical sales tax.

Texas has two different motor vehicle tax rates for rentals, depending on duration:

- Short-term contracts of 1 to 30 days: 10%

- Longer term rentals of 31 to 180 days: 6.5%

Individual cities and counties are also able to impose additional local taxes on short-term motor vehicle rentals – if this is the case in your jurisdiction, you’ll need to include that as well when invoicing customers. You may want to check your local city or county tax code, or consult with an accountant.

Both state and city/county motor vehicle rental taxes must be itemized in invoices and clearly delineated from the rest of the cost. So you’ll need to include a separate line item in each invoice to account for it.

Colorado

Colorado takes a different approach, considering the equipment rental business to be the end-user of the equipment.

As such, there is no requirement for sales tax on rentals, except when the rental exceeds three years and the person renting is considered to be the end-user. There are applicable taxes on motor vehicle rentals, though.

New York

In New York, there are some considerations when taking a look at rental taxes. While a sales tax is applied to rentals, this doesn’t apply to rentals where an operator accompanies the equipment. In that case, it’s treated not as a sale or rental, but as a service performed.

With that said, per New York State tax law, any purchase, rental, lease, or license to use construction equipment and motor vehicles by a contractor, is subject to both sales tax and use tax. It is the contractor renting from you who is liable for these taxes – that is, you’ll need to include them in your invoices when you bill your customers.

New York also has specific taxes that apply to motor vehicle rentals, including requirements for paying in advance for extended rentals.

In the end, the responsibility is on business owners to find out whether you pay sales tax on leased equipment in your state. With strict reporting requirements, you can’t afford to leave this up to chance.

Manage Your Equipment Rentals With Quipli

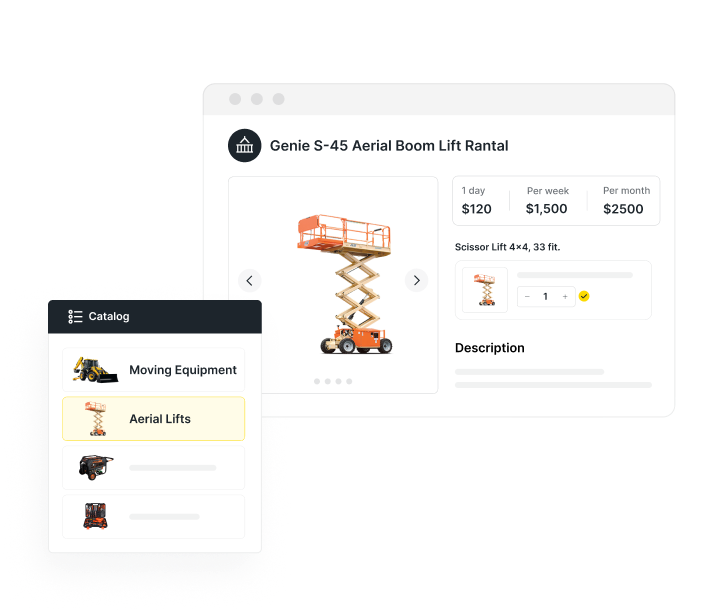

Quipli provides comprehensive software for managing equipment rental inventory and presenting an attractive website to customers. With Quipli, you can easily manage orders, invoices, and inventory without the need for separate tools.

To find out more about Quipli and its integrations with quickbooks equipment rental software, please book a demo with us today.