Table of Contents

- Equipment Rental Accounting Basics

- Accounting Tips & Strategies for Rental Companies

- How to Automate Your Equipment Rental Accounting

When you’re running an equipment rental business, you have to make a lot of ongoing financial decisions. These decisions impact every part of your operation – from equipment purchasing and maintenance to staffing, marketing, and long-term planning.

Without consistent accounting practices, it’s easy for important details to slip through the cracks – costing your business time and money.

The tips below are designed to help you stay organized, maintain cash flow visibility, and make smarter decisions about your equipment rentals. We’ll also show how tools like Quipli and QuickBooks Online can automate your financial workflows and give you more control over your bottom line.

Equipment Rental Accounting Basics

Before diving into specific tips, it’s important to understand the fundamentals of equipment rental accounting. Unlike traditional retail businesses, rental companies deal with unique accounting challenges due to the nature of maintaining, renting, and depreciating physical assets.

Classifying Rental Equipment Expenses

Rental equipment isn’t a typical expense – it’s a capital asset. That means the costs associated with acquiring and maintaining it need to be properly categorized.

Here are a few examples of common classifications:

- Capital Expenses: The upfront cost of purchasing rental equipment. These are capitalized and depreciated over time rather than expensed immediately

- Operating Expense: Day-to-day costs tied directly to using or maintaining your fleet – such as fuel, parts, servicing, and repairs

- Overhead Costs: Indirect expenses that support your rental operations — including insurance, software, employee wages, facility costs, and equipment storage

By keeping these categories clear, you’ll not only stay compliant but also gain a clearer view of what’s profitable and what’s not.

Key Financial Metrics for Equipment Rental

Successful rental businesses track specific metrics to measure profitability:

- Utilization Rate: The percentage of time equipment is rented out versus available

- Time Utilization: Rental days ÷ Available days

- Financial Utilization: Actual revenue ÷ Potential revenue if rented continuously

- Return on Investment (ROI): Revenue generated ÷ Equipment cost

- Maintenance Cost Ratio: Maintenance expenses ÷ Rental revenue

Understanding these fundamentals will help you implement the more specific accounting tips that follow.

Accounting Tips & Strategies for Rental Companies

Managing the accounting and finances of an equipment rental business can quickly become complex and time-consuming. But with the right systems and discipline around your financial processes, you can eliminate chaos and gain insights into the fiscal health of your company.

Here are ten smart tips to improve accounting, cash flow, reporting, and more.

1. Use accounting and bookkeeping software to streamline and automate your financial processes.

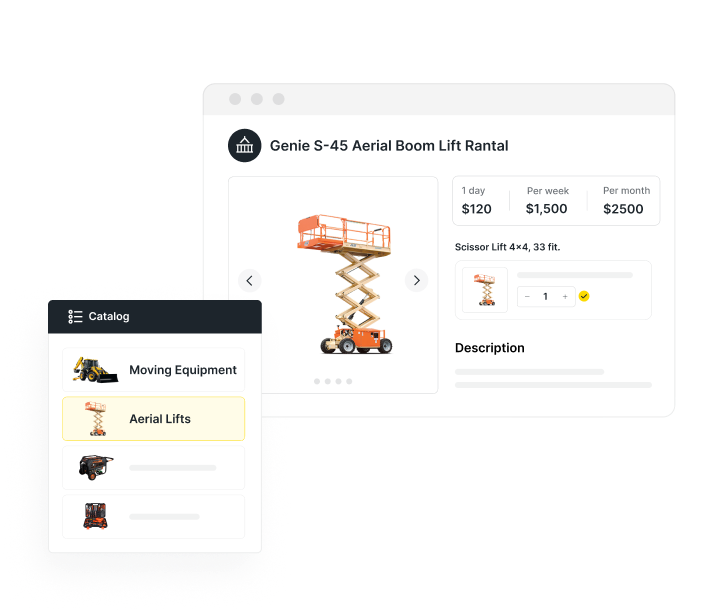

Solutions like QuickBooks Online are a must for any small to midsize business, including your equipment rental company. Quickbooks’s industry-leading financial software integrates seamlessly with your bank accounts to automatically import and categorize all of your transactions – no more manual data entry.

QuickBooks can also integrate with dedicated rental business management platforms like Quipli, creating a streamlined and largely automated process to keep things running smoothly. This saves a lot of time on accounting and unifies data across platforms.

Software provides tailored features for equipment rentals including invoicing, payment processing, tax calculations, revenue tracking by asset, reporting, and more. This removes grunt work so you can focus on big-picture financial strategy rather than paperwork.

2. Number your invoices sequentially for ease of reference.

Accounting software can automatically assign invoice numbers in order as they are generated. But even if done manually, this simple step can save lots of hassle trying to identify vague invoices by date or customer name later on. Make the number format logical and easy to follow.

3. Create and maintain a comprehensive Vendor Master File that keeps all your accounts payable information in one place.

This can include information like contacts, addresses, tax IDs, payment terms, and purchase histories.

Quipli’s software features a built-in vendor management module, which serves as a centralized database for all supplier profiles and interactions. The master vendor file acts as your AP hub to optimize vendor relationships and transactions. It enables easy reporting on payments, balances due, purchase analyses, and more.

Customers can also be tracked in a centralized Master File for full accounts receivable visibility. Consolidated customer profiles help you readily stay on top of billing, payments, account status, purchase history, and other CRM data.

This optimized customer insight assists collection efforts and nurtures long-term relationships through an understanding of their business.

4. Be sure to send out customer invoices within 48 hours after a rental concludes, while it’s still fresh in the customer’s mind.

Many software options can automatically generate and email invoices upon rental return for instant delivery. Quick invoicing while service details are top of mind helps get your bills paid faster. Customers perceive fast, professional billing as an indicator of your overall service quality.

If an upcoming due invoice remains unpaid, send reminders via email and/or phone at appropriate intervals, e.g. one week before the due, the day before the due, and the day of the due date.

Polite but firm reminders demonstrate you are monitoring accounts diligently while also giving customers an opportunity to remedy before further action is required.

Take a look at our equipment rental receipt and invoice templates if you need help.

5. Review past sales patterns, future projects, and current P&L reports to prepare a quarterly budget projecting income and expenses for the upcoming quarter.

Factor in potential fluctuations from seasonality, inventory changes, staffing needs, etc. that could impact budget vs. actuals. Adjust projections month to month accordingly. Regularly comparing your budget to real-world results highlights issues to address and helps guide smart decision-making.

Curious about equipment trends? Check out our report on construction equipment trends.

6. Be sure to understand sales tax laws, which vary widely by state and often even by city/county within a state.

For example, Los Angeles County has a 9.5% sales tax while San Francisco’s rate is 8.5%. States like California also have complex agricultural exemptions. Non-compliance can lead to audits and stiff penalties, so tax codes must be followed diligently in all regions you operate.

As a small business, you need to pay quarterly estimated income taxes to avoid underpayment fines. Work closely with your accountant and bank to ensure accurate, timely quarterly tax payments.

The IRS and state agencies impose harsh penalties on late filers. Payroll taxes must also be handled punctually each period to avoid fines. Leverage capable payroll software to fully automate tax withholding and payments.

Learn more in our equipment rental tax guide.

7. Develop proper financial reporting for your rental business

Equipment rental companies require specialized financial reports that track asset-specific metrics beyond standard P&L statements. Implement regular reporting that includes:

- Equipment Utilization Reports: Track both time and financial utilization by asset class or individual unit

- Maintenance Cost Analysis: Monitor maintenance expenses as a percentage of revenue by equipment type

- Revenue by Customer Segment: Identify which industries or customer types generate the most profitable business

- Rental Return Analysis: Calculate the ROI of each asset to inform purchase, pricing, or retirement decisions

These specialized reports help rental businesses make informed decisions about fleet expansion, pricing strategies, and when to retire underperforming assets.

8. Understand your depreciation methods and decisions

Selecting the right depreciation method has significant tax implications for equipment rental businesses. Consider:

- Straight-line Depreciation: Simplest method that spreads cost evenly over useful life

- Double Declining Balance: Accelerated method providing larger deductions in early years

- Units of Production: Based on actual usage rather than time (especially relevant for equipment with hour/usage meters)

- MACRS (Modified Accelerated Cost Recovery System): Required for tax purposes in the US

For rental businesses, the Section 179 deduction and bonus depreciation provisions in the tax code can allow for immediate expensing of certain equipment purchases, dramatically improving cash flow in the year of acquisition.

Consult with a tax professional to determine which depreciation strategies align best with your business cash flow needs and tax situation.

9. Navigate the impact of IFRS 16 on rentals

If your business operates internationally or works with larger enterprises, understanding the International Financial Reporting Standard (IFRS) 16 is crucial. This accounting standard significantly changed how leases are recognized, measured, and reported.

Key considerations include:

- Lease Classification: Under IFRS 16, most leases appear on the balance sheet as both assets and liabilities

- Disclosure Requirements: Enhanced disclosures about lease arrangements are required

- Impact on Financial Ratios: Balance sheet changes affect key metrics like debt-to-equity ratios

While smaller rental companies may not directly implement IFRS 16, understanding these standards helps when dealing with larger clients who follow these protocols, particularly when negotiating long-term rental contracts.

10. Don’t forget about including leased equipment

Many rental businesses supplement their owned fleet with leased equipment to meet seasonal demands or test new product lines. This creates additional accounting considerations:

- Asset Classification: Properly distinguish between owned assets and leased assets in your accounting system

- Liability Tracking: Record lease payment obligations as liabilities on your balance sheet

- Sub-Rental Accounting: Track revenue and costs for equipment you’re re-renting to customers

- End-of-Lease Planning: Create accounting provisions for purchase options or return conditions

Carefully accounting for both owned and leased equipment gives you a complete picture of your financial position and helps optimize your fleet mix for maximum profitability.

How to Automate Your Equipment Rental Accounting

Modern rental businesses can dramatically streamline their accounting processes through automation. Here’s how Quipli can transform your equipment rental accounting:

1. Seamless QuickBooks Online Integration

Quipli’s QuickBooks Online integration automatically syncs all rental transactions, including:

- Real-time invoice creation when rentals are completed

- Accurate revenue categorization by equipment type

- Customer payment processing and application

- Vendor bill tracking and payment recording

This bi-directional integration eliminates double-entry and ensures your financial data is always consistent across systems.

2. Automated Financial Reporting

Quipli generates critical financial reports automatically, giving you instant visibility into your rental business performance:

- Daily revenue snapshots by location, equipment category, or individual asset

- Utilization reports that highlight your most profitable equipment

- Accounts receivable aging with automated customer payment reminders

- Return on asset investment calculations that inform purchasing decisions

These automated reports save hours of manual calculation while providing deeper insights into your business performance.

3. Streamlined Tax Management

Managing complex rental taxes becomes simple with Quipli’s automated tax features:

- Built-in tax rate tables that automatically apply the correct rates based on location

- Proper tax classification for rentals versus sales items

- Automatic tax reporting for filing periods

- Digital record-keeping for tax compliance and audit preparation

By automating these accounting processes, your rental business can reduce administrative overhead, improve accuracy, and gain the financial insights needed to make strategic decisions.

Quipli’s QuickBooks Online integration can help you keep your financials running smoothly

With strict accounting discipline in place, rental owners can cut through the chaos, get financial insights, stay compliant and free up time to focus on big priorities. Partnering with capable solutions like Quipli optimizes accounting workflows to run a tighter, more profitable rental operation.

Partner with a specialized platform like Quipli for rental-optimized accounting automation. Quipli integrates with QuickBooks Online to handle invoicing, collections, taxes, and reporting so you can focus on your business.

Reach out today to learn more and request your free demo!